How to Invest in Gold Bullion? The Ultimate Guide to Gold Investment

For centuries, savvy investors have been aware of the importance of gold as part of a well-balanced portfolio. In addition to offering wealth diversification, gold is a world-renowned safe haven for investors, offering the ultimate insurance and protection against turbulent economic times.

History illustrates that gold is a timeless asset, not only proving to be a successful preserver of wealth, but high gold prices and record demand has ensured it has outperformed many other forms of investment.

Gold has remained a popular asset since the last financial crisis, when confidence in financial institutions was shaken. Just over a decade later and 2020 proved to be another unprecedented year due to the Covid-19 pandemic.

The response of central banks has been unprecedented money-printing, historically low interest rates, and increasing public spending, raising national debt to new peace-time highs, and risking high levels of inflation.

Gold has reached new all-time highs in the UK repeatedly since 2020 and into 2023, as the economic backdrop drives further demand for this safe haven metal. Soaring inflation has sparked a cost-of-living crisis, and seen central banks aggressively hike interest rates. Falling economic growth has raised concerns of recession to come, while inflation remains stubbornly high. Central banks and investors are driving record demand for gold as they seek safe places to keep their money, and gold is expected to rise to further records in the months to come.

View our annual gold price forecast for our analysis on the prospects for gold in 2023.

How to Buy Gold?

Our investment guide provides essential reading for all investors on how to buy gold. If you've never bought gold before then we can help explain how to invest in gold for beginners. Even seasoned investors can benefit though, and this guide is packed with must-read information and advice on how to invest in gold coins and bars, including why buy gold, where to buy gold and storing gold.

The guide also looks into bars vs coins, gold vs silver, capital gains tax on bullion and the benefits of owning physical gold over paper and electronic gold, plus much more.

Why Invest in Gold?

In order to know if gold is a good investment, it is important to understand why people buy gold. In times of economic uncertainty and instability, buying gold makes more sense than other assets. With confidence in the banking system and worldwide economy at an all-time low, gold bullion could be the ultimate insurance and should act as an essential part of everybody’s investment portfolio. With the famous yellow metal in greater demand than ever, there are many reasons why people should buy gold. Owning gold could be the ultimate way to preserve your wealth, and possibly make a healthy return in these uncertain times. It’s an age old question which people have been asking for centuries – where is my money really safe? And more and more people are now choosing the oldest answer:

GOLD.

Read more about the benefits of buying gold.

Why Buy Physical Gold? Physical Gold Vs ETFs

As the old saying goes; if you don't hold it, you don't own it. There really are numerous benefits of physically holding your gold in your hands, as opposed to buying electronic gold (ETF) or paper gold. In these unpredictable economic times of banking instability, low interest rates, underperforming currency markets, volatile stocks and repeated rounds of printing money, gold offers a welcome safeguard to the turbulence. However this is not just any form of gold, but physical gold. Physical gold is a timeless asset which will always have a value and always lasts the test of time. Holding physical gold bars and/or gold coins provides the ultimate control and insurance for your wealth against financial crisis in an underperforming wider economy.

Read more about the

benefits of owning physical gold.

Where to Buy Gold?

Research is everything. Your decision to buy gold online wouldn’t have been taken lightly and should be backed by your own research. Much the same, when it comes to selecting your chosen bullion dealer, again research is vital. The internet is the best place to conduct your research. The internet holds information about the impartial experiences, opinions and recommendations of millions of people all around the world. It sounds obvious, but why not start your research by simply typing in the bullion dealers brand name into Google. The internet really is the world's largest open forum in which companies have no control. It will quickly become apparent if a bullion dealer has a negative online reputation, in which case they should be avoided at all costs.

Read more about where to buy gold.

When to Invest in Gold?

Looking back at historical data; in hindsight it is easy to identify 2005/06 as a great time to buy gold bullion, before the constant rises when the price of gold stood at just £250 per troy ounce. We are often asked whether it's a good time to invest in gold, and whether the price will rise?

Unfortunately, there's no exact science to knowing when to buy gold, but there are lots of effective and timeless techniques and indicators that most successful investors use to help them spot the right time to buy gold.

Read more about the best time to buy gold.

Gold Bars Vs Gold Coins?

Whether you’re new to bullion investment or not, deciding whether to invest in bullion bars or bullion coins should take some consideration. Before making this decision, it would be advisable that you conduct your research as there is no definitive right or wrong answer, it will vary depending on the needs and circumstances of the individual investor. However, as when making any other investment there are several factors to consider including: the value of your investment and the product premiums, how long you plan on holding your gold, how you will store it, capital gains tax (CGT) and how you plan on realising the value of your investment.

Read more about gold bars versus coins.

Should I Buy Gold & Silver?

Many investors spend time deciding whether to buy gold or buy silver, however the savviest investors own both. Whereas gold could offer the ultimate insurance and protection against uncertain economic times, silver is a more speculative investment. Despite gold and silver both being commonly invested precious metals, silver is an entirely different investment which can realise substantial profits despite the initial VAT outlay. It’s because of these differences that owning both gold and silver together can be of benefit.

Read more about the benefits of owning silver.

Do I Pay Capital Gains Tax on Gold?

Capital Gains Tax - or CGT - is a tax on the gains or profit you make when you sell, give away or otherwise dispose of something. It applies to assets that you own, such as bullion, shares or property. There's a tax-free allowance of £12,300 (2022/23) and some additional relief that may reduce your Capital Gains Tax bill.

Most bullion investors will never have to pay this tax due to the size of their investment and many other investors choose to only buy tax-free British gold coins which are exempt from CGT; such as gold Sovereign coins and gold Britannia coins, however, it is important that investors check first, so they know where they stand.

Read more about paying CGT on gold.

Is Bullion Subject to VAT?

The good news is investment grade gold is VAT-free. This includes all the gold bullion bars and coins on our website. This helps maximise your money, allowing you to put all of your budget into the initial outlay.

Unlike gold, VAT is payable on silver at 20% making silver a more long term, speculative investment. However, due to the volatile nature of the silver price, returns are often quickly realised. If you are VAT registered and think you may be able to claim your VAT back, then we advise you speak to your accountant.

Read more about paying VAT on silver.

Where Should I Store my Gold?

The physical possession and control of your bullion is one of the main benefits of investing in gold bullion bars and coins over electronic or paper gold, however you must consider where to store your gold. There really is no one correct answer, the truth is you can do with it as you please and can store it where you like; it really is down to personal preference. Storing gold bullion really isn’t anything new; people have been successfully storing gold and silver bullion for centuries and it is particularly common in Germany and India. On a basic level there are four different options; allocated storage, a bank safety deposit box, a home safe or be a bit more creative. Although allocated storage with BullionByPost is the most secure, all four options offer a variety of pros and cons, these should be investigated before making a decision as to how to store your gold bars and gold coins.

Read more about storing your gold bullion.

Why Buy Gold Online at BullionByPost?

BullionByPost is the largest and most trusted bullion dealer in the UK dispatching thousands of parcels for free fully insured delivery every month. BullionByPost is a fully authorised distributor for world-renowned refiners such as Umicore, Heraeus, PAMP and Metalor, as well as an authorised distributor for The Royal Mint in the UK.

Read more at about the bullion refiners we sell at BullionByPost.

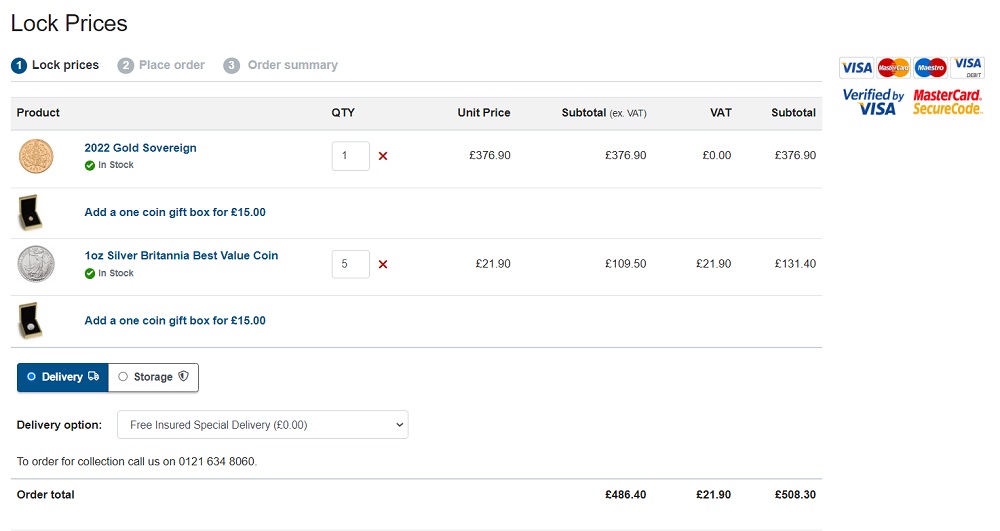

How to Buy Gold Online at BullionByPost?

Buying gold online at BullionByPost is quick, simple and secure. You can create and register your account online in as little as two minutes. Once your account is set up, you can buy gold and silver bullion online, 24 hours a day at the click of a button. Your online account will also allow you to track the performance of your gold investment against the current price of gold, as well as providing you with the latest product news and a safe place to store your invoices. With a comprehensive range of gold and silver bullion products available at low margins, buying gold in the UK has never been so safe and easy.

An example of the BullionByPost checkout process. Prices are subject to live changes.

Register your FREE online account today and receive a host of benefits including our Gold Price Alert Service, 24 hour access to buy gold quickly and safely, access to your invoices and full order history to monitor your investment performance, regular financial news and offers direct to your inbox, plus much more. Click here to register your FREE online account today.

Related Links: If you have any questions about investing in gold, please feel free to contact our knowledgeable and friendly team on 0121 634 8060 who will be happy to talk your through any queries you may have. Alternatively, you can email us at sales@bullionbypost.co.uk and we will get back to you as soon as possible.

Buy Gold Bullion | Buy Gold Bars | Buy Gold Coins | Buy Silver | Buy Gold Sovereigns | Gold Price | Gold Price Forecast

View our Top 5 Gold Investments and our Top 5 Silver Investments

- How To Buy Gold

- How to Buy?

- Payment Options

- Delivery Options

- Gold Storage

- Storage at Brink's

- Gold Investment Guide

- Why buy gold?

- Is gold a good investment?

- Why physical gold?

- Best time to buy gold?

- Gold bars vs coins?

- Gold vs Silver

- Gold - Silver Ratio explained

- VAT on bullion

- CGT on bullion

- Legal tender coins

- Top 5 Gold Investments

- Top 5 Silver Investments

- Gold vs ISAs

- Gold vs Buy-to-Let

- Gold vs FTSE 100

- Gold vs Bitcoin

- Where to buy gold?

- Why buy from us?

- Where to sell gold?

- Coin Shops

- Gold Price Forecasts

- Top 10 Gold Producers

- Top 10 Gold Reserves

- Gold Britannia vs Sovereign

- Britannia coin designs

- Sovereign coin designs

- Sovereign Mintages

- Sovereign mint marks

- British coin specs

- What is a proof coin?

- Royal Mint bullion

- The Queen's Beasts

- Royal Mint Lunar Coins

- Bullion Refiners

- British coin mints

- Krugerrands

- Gold Tola - India & Pakistan

- Bullion Index